Alternative Investments In Difficult Times

Global equity markets have had a very good run, but we are clearly entering difficult times for mainstream investment channels.

Global equity markets have had a very good run, but we are clearly entering difficult times for mainstream investment channels.

Regular readers will know that we have strong reservations about the way mainstream finance has rushed to invest – or should that be “throw money”? – at the alternative-finance sector.

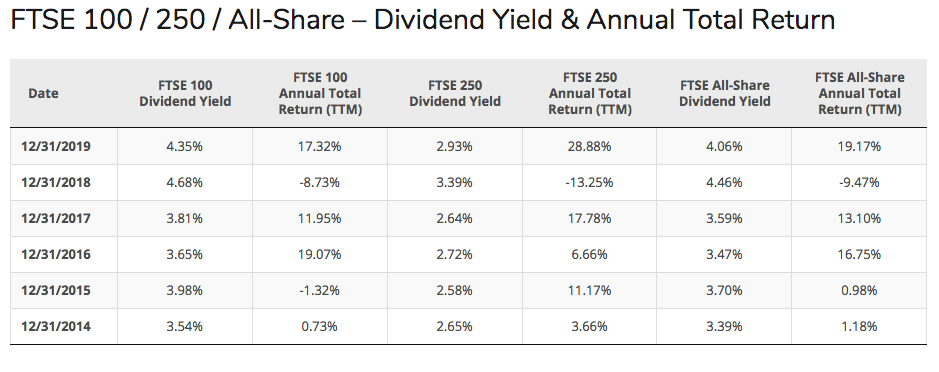

Source: Siblis Research

The major issue that springs to mind is whether it’s better to invest directly in alternative-finance products or the companies that provide them. These are the questions:

- Dividend yield?

- Capital return?

- Correlation between main equity market and share price performance?

The table shows the year-on-year returns and dividend yields for the major share indices. Yields in excess of four per cent across the major indices are well above historical averages. Yet lenders committing capital directly to Money&Co. have achieved a gross return of over eight per cent.

The potential capital return is matched by commensurate risk. Markets have done well in recent months, but volatility has always been the name of the game in equity investing. Money&Co. lenders have to account for the risk of default – currently running at an annualised default rate of 0.03 per cent over more than five years of loan facilitation. Compare that to a market correction.

That pretty much answers the question about correlation between equity prices and platform lending performance (if the platform has a conservative risk-analysis profile, such as ours). Correlation? There’s hardly any.